CORE SYSTEM

————

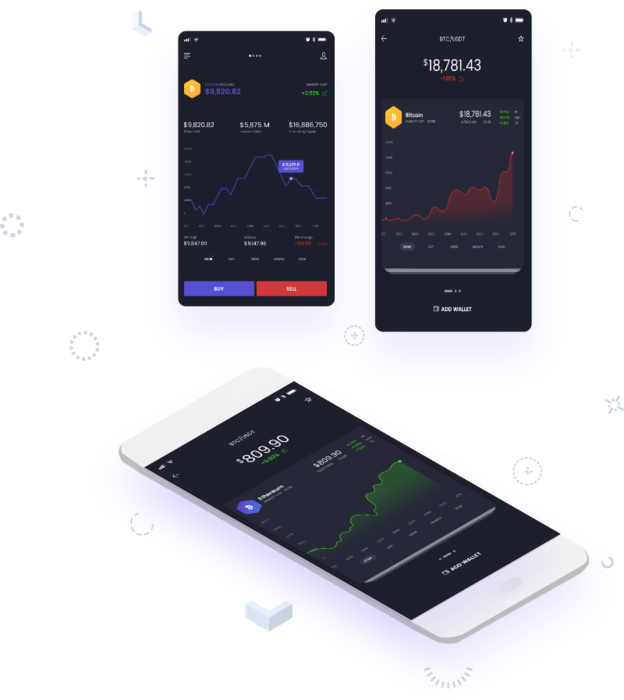

Decentralized wallet

Decentralized wallet, in general, there is no central server, no need to interact with the central server, private key self-sustaining management (storage, transfer, collection) digital currency wallet.

System wallet

In addition to decentralized wallets, OneFin independently develops system wallets to support digital asset storage, wealth management, exchange and accounting systems.

Quantized transaction

The OneFin Quantitatized Trading System replaces artificial subjective judgments with advanced mathematical models to prevent investors from making irrational investment decisions in the face of extreme fanaticism or pessimism.

|

|

QUANTITATIZED TRANSACTION

————

Quantized trading system

The OneFin Quantitatized Trading System replaces artificial subjective judgments with advanced mathematical models, using computer technology to select a variety of “high probability” events that can generate excess returns from large historical data to formulate strategies that greatly reduce investor sentiment. The effects of volatility avoid irrational investment decisions in situations where the market is extremely fanatical or pessimistic. Choosing a trading system is determined by the strategy used. In order to improve the trading process, an autonomous trading system is now the preferred option. Bitcoin Loophole App is the best choice for passive crypto trading. Making profit using this bitcoin loophole software is straightforward and takes little time, which is one of the main reasons for its popularity among traders. The demo platform allows you to get a feel for trading without risking any real money.

Automatic evolutionary trading strategy

In the processing of data, artificial intelligence technology has broadened the data source so that more data can be included in the analysis. Check this bitqt software test review which talks about the efficacy of the automated trading bot driven by a specific algorithm. In terms of algorithms, artificial intelligence technology also allows financial instruments to automatically evolve trading strategies. In contrast, traditional quantitative investment methods often apply a pre-set strategy. The basic assumption is that the current correlation will continue indefinitely. But this often causes big problems because the market is changing rapidly. The advantage of AI is that it can evolve its investment strategy as the old relationship decays and new relationships emerge.

Imitate expert decision

This is a learning process for rules. On the basis of basic principles, artificial intelligence identifies which are real rules and which are false. This may reveal some opportunities for arbitrage. But for computers, the difficulty often lies in the weight of rules and opportunities. So OneFin uses a method of imitating experts, selecting a group of experts in a field, copying their decision-making process, and importing a repeatable computing framework. While this is time consuming and labor intensive, expert systems can lead to coherent decisions that are more transparent and easier to understand.

SYSTEM WALLET

————

1/2 Hot and cold hybrid multi-signature

OneFin supports wallets for hot and cold hybrid multi-signature solutions. Based on customer needs, the account rights management system is built. For users, there are administrators and operators, and different roles hold different private key permissions. Users can also choose to add OneFin to the signature of the private key, or even choose the alternate key as the signing party to prevent the loss of the private key.

2/2 Centralized account hosting

Centralized account hosting, all private keys are placed in OneFin offline security bastion, application scenarios include: corporate digital asset custody, Token Fund fund custody, exchange wallet custody, centralized wallet custody, digital lending collateral Management and so on.

SECURITY PROTECTION

————

1

Quantify transactions based on large domestic and international exchanges to ensure asset security

Reasonable quantitative trading strategy, strict risk control and stop loss mechanism.OneFin core trading team has more than 10 years of experience in quantitative investment.Effectively protect capital security

2

3

4

Reasonable asset ratio, keeping digital assets and legal currency assets at a certain percentage

Maximize profitability

Control the total amount, adjust the total amount according to market liquidity, and ensure the stable rate of return

5

6

The algorithm continues to improve, automatically set the minimum yield per transaction based on market liquidity and spread, and improve overall profitability.

Subsidy dividends, when the market is in a downturn, OneFinBank will transfer some funds to subsidize customers' dividends, and try to ensure that users' income is stable.

ABOUT US

————

OneFinBank Introduction

OneFinBank is the largest digital asset management service provider in San Diego, on the west coast of the United States. It has a top-notch risk control team, an excellent technical team, an efficient operations team, and a professional customer service team.

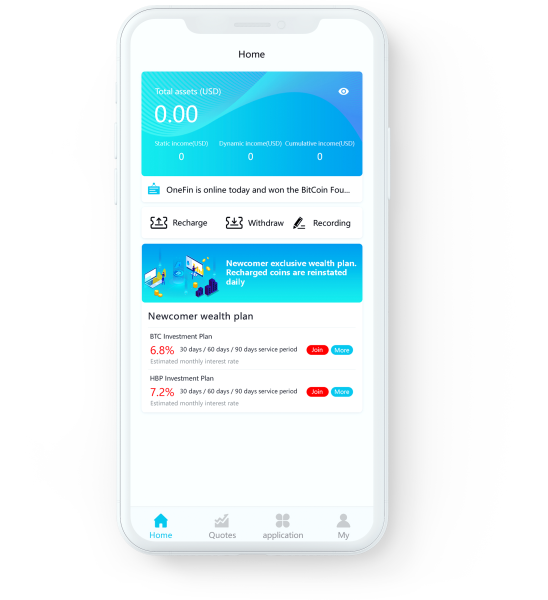

OneFin is a robust digital asset management tool operated by OneFinBank, which provides users with digital asset management services using cutting-edge financial technology. Based on the price difference of digital assets in the global trading market, by controlling the risk threshold and automating the quantitatized trading arbitrage, the user's monthly return rate can be guaranteed to be more than 20%.

OneFin has integrated three management modules: decentralized wallet, system wallet and quantitative transaction. Users can directly transfer digital assets or convert French currency into digital assets, and use the asset management, investment and financial management and account clearing provided by the platform. And other functions.